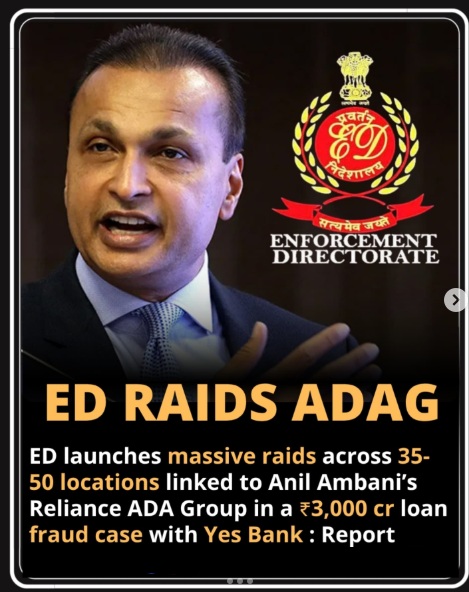

On July 24, 2025, the Enforcement Directorate (ED) conducted extensive raids across multiple locations linked to the Reliance Anil Dhirubhai Ambani Group (ADAG), chaired by industrialist Anil Ambani. These coordinated searches, spanning over 35 premises and involving approximately 50 companies and 25 individuals, mark a significant development in an ongoing investigation relating to alleged financial irregularities and loan fraud involving Yes Bank.

Background of the Investigation

The ED’s raid is part of a wider probe into alleged money laundering activities and loan fraud linked to a staggering ₹3,000 crore involving loans extended by Yes Bank to several companies under the Anil Ambani group, notably Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). The investigation traces its origins to two FIRs filed by the Central Bureau of Investigation (CBI) in September 2022 and has since been bolstered by intelligence inputs from multiple key regulatory bodies including the Securities and Exchange Board of India (SEBI), the National Housing Bank (NHB), the National Financial Reporting Authority (NFRA), and Bank of Baroda.

Details of the Raids and Allegations

The raids targeted premises predominantly in Mumbai and Delhi. While Anil Ambani’s personal residence was not among the sites searched, the focus was firmly on business offices and executives associated with the group. The ED is probing a complex and allegedly planned scheme to siphon off public money via fraudulent loan obtaining and bribery, implicating several institutions and individuals.

Specifically, the investigation centers on:

- Alleged diversion and illegal use of funds obtained through loans sanctioned by Yes Bank and other financial instruments.

- Suspicions of bribes paid to bank officials, including Yes Bank’s former promoter Rana Kapoor, to facilitate these loans.

- Use of shell companies to launder and divert funds away from legitimate business activities.

- Backdated Credit Approval Memorandums and inadequate due diligence in loan sanctioning.

- Possible cheating of banks, investors, shareholders, and public institutions.

These activities reportedly occurred over the period of 2017 to 2019, involving nearly ₹3,000 crore of public funds.

Contextual Background: Anil Ambani’s Business Challenges

This raid adds to a series of challenges faced by Anil Ambani in recent years, following the well-publicized split between the Ambani brothers. Once a towering business empire, Anil Ambani’s group has faced a series of financial crises, defaults, and regulatory setbacks. Companies such as Reliance Communications, Reliance Capital, Reliance Power, and Reliance Infrastructure have struggled under immense debt burdens, bankruptcy filings, and business shutdowns.

Despite attempts to revive and restructure businesses with focus areas like infrastructure, defence, and clean energy, Ambani’s conglomerate remains under heavy scrutiny due to its financial troubles and regulatory investigations.

Ongoing Investigation and Impact

The ED, leveraging inputs from multiple agencies, aims to bring clarity and accountability to these allegations. The investigation seeks to uncover the extent of fraudulent financial behavior and the network that enabled it. As this probe unfolds, it poses significant reputational risk and potential legal consequences for the individuals and entities involved.

The high-profile nature of these raids reflects intensified regulatory scrutiny of corporate governance, lending practices, and financial probity in India’s business landscape. The outcome of this investigation could have broad implications for corporate practices and enforcement norms in the country.

Conclusion

The 2025 raids on Anil Ambani’s group underline the Indian government’s continued resolve to clamp down on alleged financial irregularities and corruption in major business houses. While the allegations are serious and the investigation ongoing, it remains to be seen how the Reliance Anil Dhirubhai Ambani Group navigates this period of adversity amidst efforts to stabilize and rebuild.